At CapitaLand Malaysia Trust (CLMT), sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long term economic value, and contributing to the environmental and social well-being of our communities. CLMT's material environmental, social and governance (ESG) factors are aligned with CapitaLand 2030 Sustainability Master Plan, which was launched in 2020, and will be reviewed by the Board of Directors together with Management every two years.

The CapitaLand 2030 Sustainability Master Plan steers our efforts on a common course to maximise impact through building a resilient and resource efficient real estate portfolio, enabling thriving and future-adaptive communities, and accelerating sustainability innovation and collaboration. Ambitious ESG targets have been set which include carbon emissions reduction targets validated by the Science Based Targets initiative (SBTi).

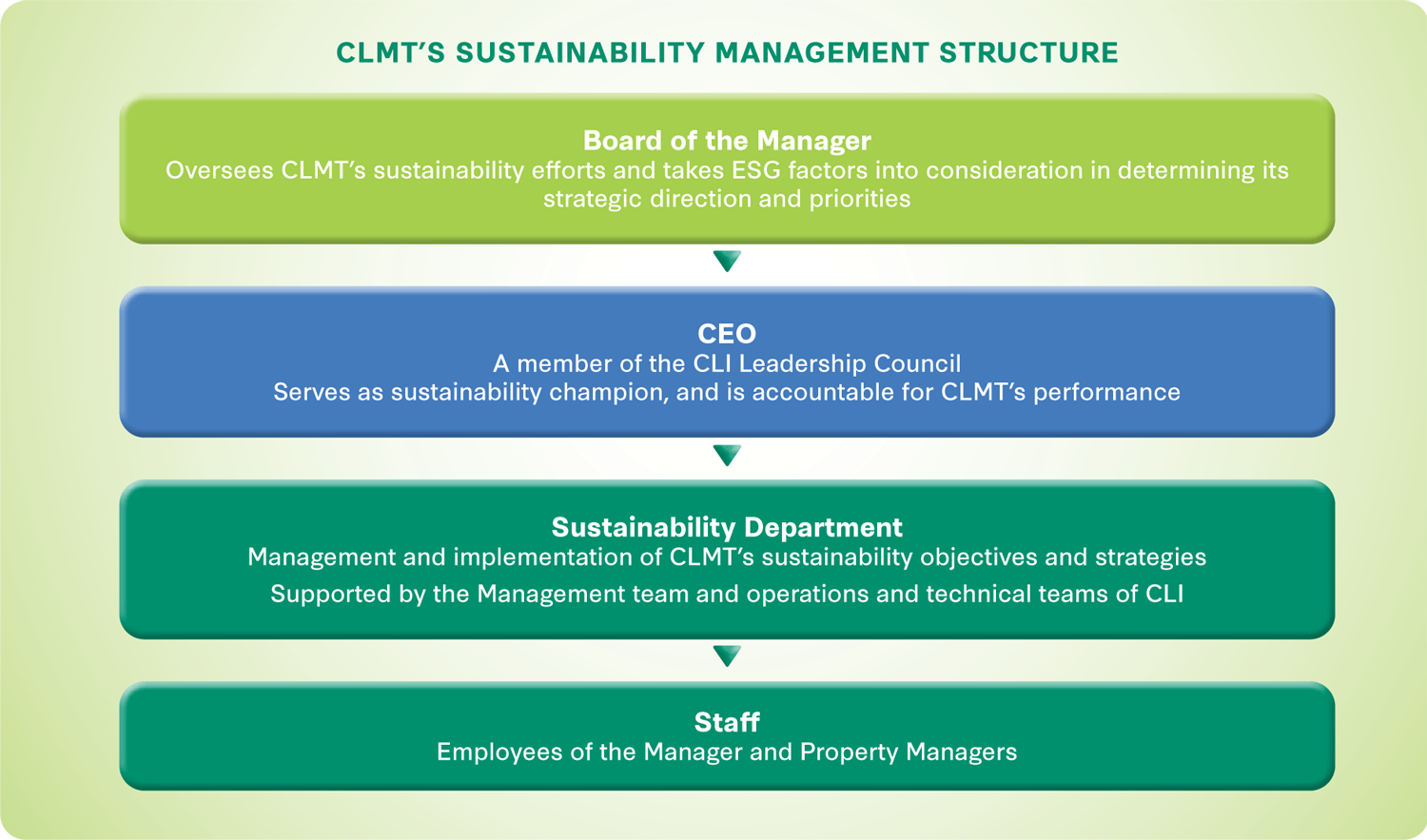

The Board of the Manager of CLMT is responsible for overseeing the CLMT's sustainability efforts and takes ESG factors into consideration in determining its strategic direction and priorities. The Board also approves the executive compensation framework based on the principle of linking pay to performance. CLMT's business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices and are cascaded throughout the organisation.

At CLMT, sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of our communities. The material environmental, social and governance (ESG) factors have been identified with set targets for 2030, in alignment with the CapitaLand Investment 2030 Sustainability Master Plan (SMP), which was refreshed in 2023 as part of the review by the Board of the Manager of CLMT together with Management.

CLMT's ESG plan steers our efforts on a common course to maximise impact through building portfolio resilience and resource efficiency, enabling thriving and futureadaptive communities, and stewarding responsible business conduct and governance. Ambitious ESG targets have been set by CLI and adopted throughout the organisation, including CLMT. These targets include carbon emissions reduction targets validated by the Science Based Targets initiative (SBTi). In 2023, the SMP targets have been revised to elevate SBTi-approved targets in line with a 1.5°C scenario, incorporate Net Zero commitment, and enhanced focus on social indicators.

The Board of the Manager of CLMT is responsible for overseeing REIT's sustainability efforts, and takes ESG factors into consideration in determining its strategic direction and priorities. The Board also approves the executive compensation framework based on the principle of linking pay to performance. The Manager's business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices and are cascaded throughout the organisation.

Being a CLI-sponsored real estate investment trust (REIT), CLMT's sustainability targets and efforts are guided by CapitaLand Investment (CLI). The Manager and the Property Managers who oversee the operations of CLMT abide by CLI's sustainability framework, policies and guidelines, as well as ethics and code of business conduct.

CLMT is aligned with CLI 2030 SMP unveiled in 2020 to elevate the Group's commitment to global sustainability in the built environment. The SMP drives CLI's sustainability efforts in the ESG pillars, enabling CapitaLand Group to create a larger positive impact for the environment and society.

CLI 2030 SMP is regularly reviewed where necessary to complement the Group's business strategy and align with climate science.

In 2022, CapitaLand elevated its Scope 1 and 2 carbon emissions reduction targets which were validated by SBTi to be in line with a 1.5°C trajectory, currently the most ambitious designation available through the SBTi process. This will translate to Net Zero in 2050.

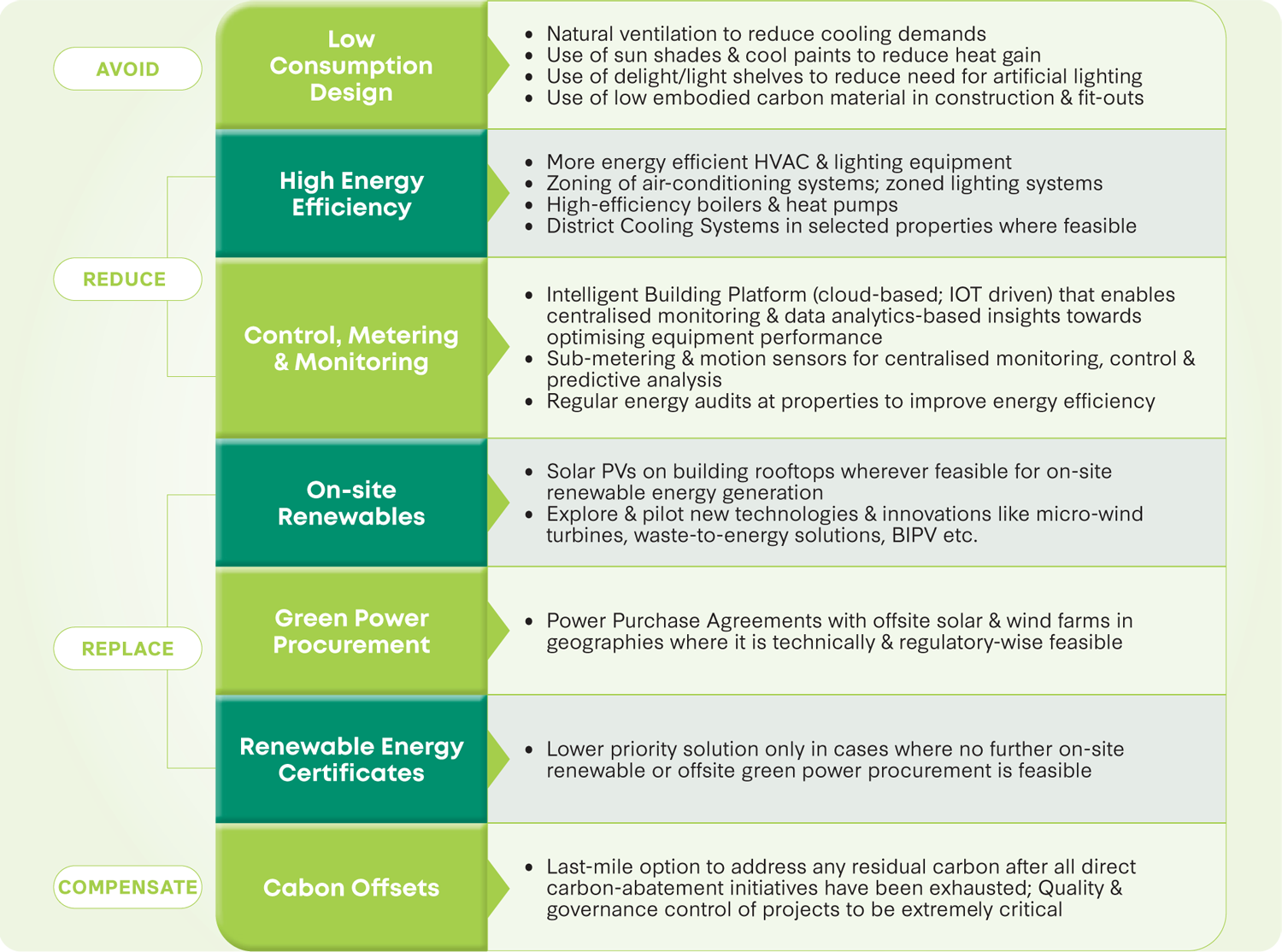

Aligned with the Group's elevated science-based target, CLMT commits to reducing its absolute Scope 1 and 2 emissions by 46% by 2030 from a 2019 base year and aims to achieve Net Zero by 2050, consistent with the effort required to limit global temperature increase to below 1.5°C. To operationalise its SBTi approved carbon emissions reduction target for Scope 1 and 2 emissions, CLMT reviewed its carbon intensity reduction targets and other environment targets, including changing reference to 2019 as the baseline year. CLMT also aims to conduct a comprehensive review of its Scope 3 emissions to better track and disclose its material Scope 3 emissions, and is committed to developing Scope 3 emission goals aligned to science-based targets. Over the next decade, as part of CLI's roadmap to Net Zero, CLI and CLMT will prioritise the decarbonisation levers indicated (on page 116), and in particular, continue to source globally for new ideas and technologies to achieve higher energy efficiency and intensify its renewable energy integration efforts.

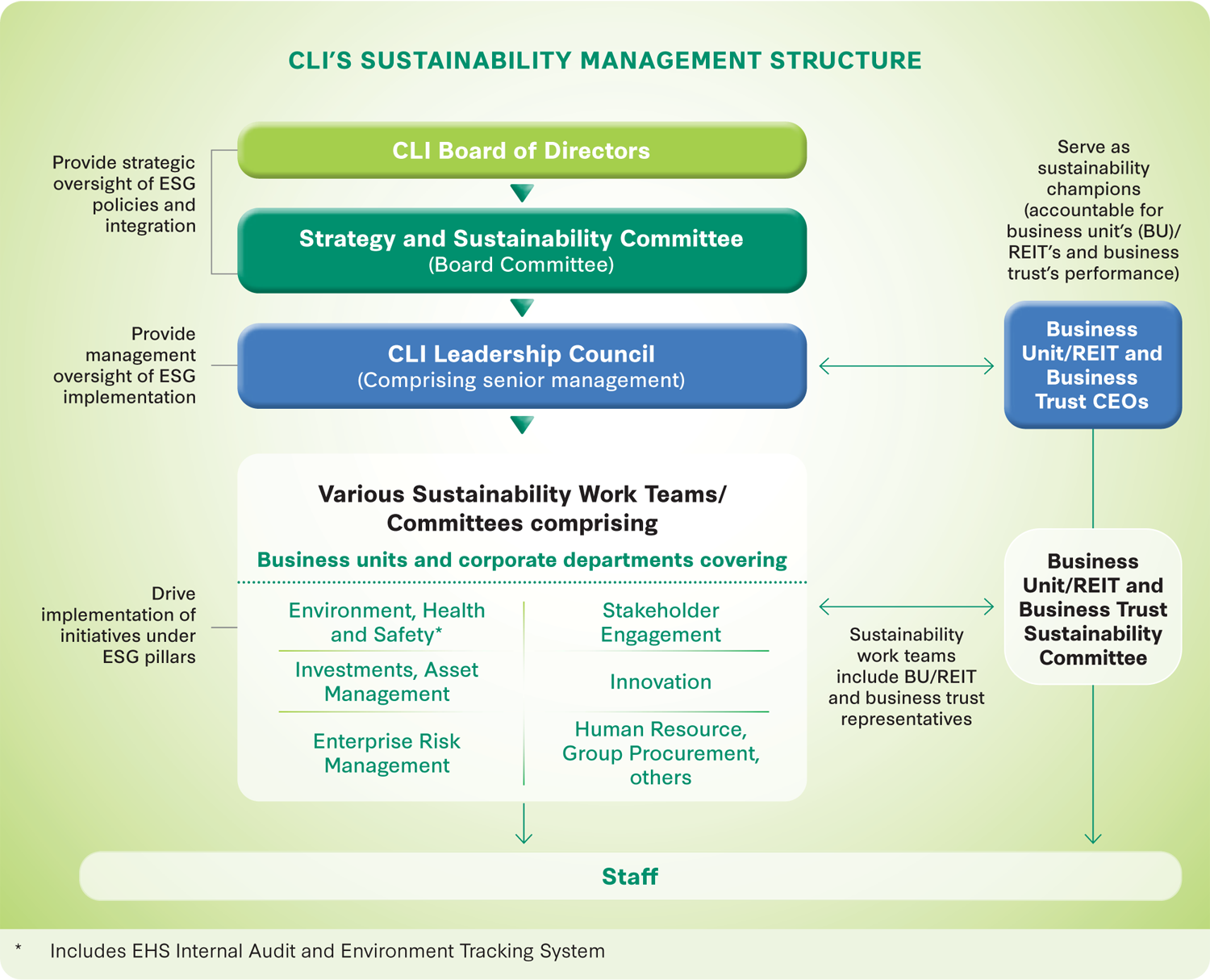

The CLI Board recognises the importance of sustainability as a business imperative, and ensures that sustainability considerations are factored into CLI's strategy development. This enables CLI to remain competitive and resilient in an increasingly challenging business environment.

The CLI Board is kept informed on a regular basis through the Strategy and Sustainability Committee (SSC) on the Group's sustainability management performance, key material issues identified by stakeholders, and the planned follow-up measures. Additionally, the CLI Board is typically updated by the Risk Committee and Audit Committee at least once a year and at ad hoc Board meetings. The Board discusses matters relating to sustainability risks and relevant performance metrics, which include carbon emissions and its progress on achieving the reduction targets, green certification, human capital development, stakeholders' expectations on climate change, social impact and/or other matters. The Board is also informed of any incidents relating to workplace safety, business malpractice and environmental impact, which may include climaterelated damage or disruptions.

A Lead Independent Director chairs the SSC which is a Board Committee. The SSC is responsible for overseeing CLI's sustainability strategies and goals, including providing guidance to management and monitoring progress against achieving the goals of sustainability initiatives. The SSC typically meets twice a year, with additional meetings convened as necessary.

The CLI Leadership Council makes strategic resource allocation decisions and meets on a regular basis. The council comprises the Group Chief Executive Officer (CEO), CEOs of the various business units and key management executives of the corporate office.

The sustainability work teams comprise representatives from CLI's business units and corporate functions. Each business unit has its own Environmental, Health and Safety (EHS) Committee to drive initiatives in countries where it operates with support from various departments.

For CLMT, the Board of the Manager considers sustainability issues as part of its strategic formulation, confirms the material ESG issues listed by the Manager and oversees the management and monitoring of the material ESG factors.

The Board of the Manager sets CLMT's risk appetite, which determines the nature and extent of material risks that CLMT is willing to take to achieve their strategic and business objective. As part of the material risk issues being highlighted, climate change has been identified as critical. The Board is actively involved in discussions on climate-related initiatives and regularly reviews climate change risks as part of its Enterprise Risk Management (ERM) Framework.

The update to the Board is conducted at the quarterly Board meetings and covers relevant climate-related topics including CLI 2030 SMP, green capital expenditure plan, performance metrics such as carbon emissions performance, progress on the reduction targets, as well as stakeholders' expectations on climate change. Any environmental incidents, which may include climate-related damages or disruptions, are also reported to the Board. As EHS factors are considered as part of the asset investment evaluation process and strategy, they are presented to the Board where relevant.

On 6 June 2023, the Securities Commission Malaysia and Bursa Malaysia rolled out of a new mandatory onboarding programme on sustainability for directors of Public Listed Companies on Bursa Malaysia. The Mandatory Accreditation Programme (MAP) Part II: Leading for Impact (LIP) is an extension to the existing MAP, now known as MAP Part I under the Bursa Malaysia Main Market Listing Requirements. As at 31 December 2023, three directors of the Board of the Manager have completed the MAP Part I and II.

A Sustainability Department led by the CEO of the Manager oversees sustainability objectives and strategies directly to ensure greater focus on sustainability and climate-related matters for CLMT. The Sustainability Department is responsible for providing timely and regular updates on CLMT's sustainability matters to the Board of the Manager.

These updates are in relation to sustainability risks, and relevant performance metrics, which include carbon emissions performance, progress on achieving the reduction targets, green certification, human capital development, as well as stakeholders' expectations on climate change and/or other social matters.

The Sustainability Department works closely with key members from various departments including finance, investment and portfolio management, as well as operations department and technical teams of the Sponsor in carrying out strategies and relevant activities, abiding by CapitaLand's sustainability framework and policies.

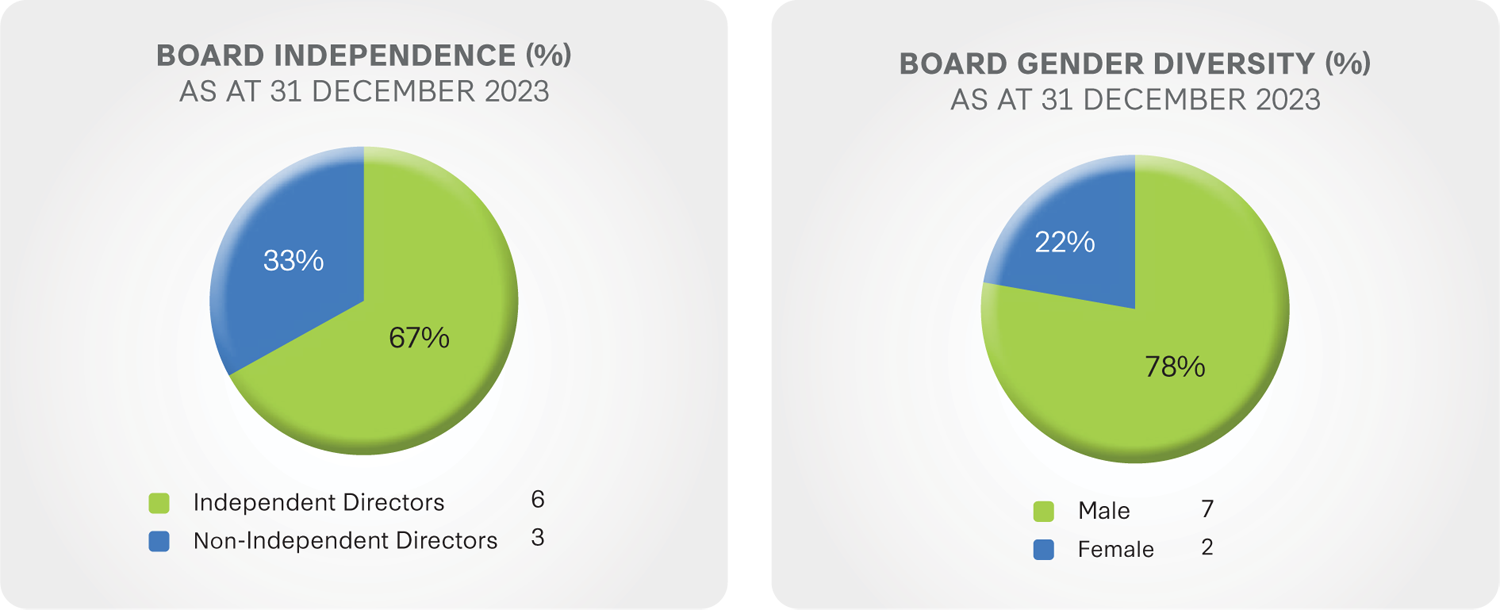

The Board of the Manager embraces diversity and has in place a Board Diversity Policy which ensures that the Board comprises talented and dedicated Directors with a wide mix of expertise (including industry, domain and functional expertise), skills, experience and perspectives. This is with due consideration to diversity in gender, age, tenure, ethnicity and cultural background, as well as any other relevant aspects of diversity.

The Manager's Board Diversity Policy targets, plans and progress are detailed on page 81 to 83 in CLMT AR 2023.

With respect to female representation, the Nominating and Remuneration Committee (NRC) notes the Malaysian Code on Corporate Governance 2021 target of women making up 30% of the boards of Bursa Malaysia-listed companies by 2030. In its annual review of the Board's composition, the NRC expressly considers and includes a commentary to the Board about diversity in the composition of the Board. The Board aims to achieve at least 30% female representation in the composition of the Board over the next few years when reviewing the nominations for the appointment and reappointment of Directors for a new term. Currently, the proportion of female representation in the Manager's Board composition has increased to 25% (or 2 female Directors out of a total of 8 Directors) following the resignation of Mr Lui Chong Chee on 1 February 2024.

CapitaLand was one of the first companies in Singapore to voluntarily publish an annual Global Sustainability Report since FY 2009, and has had the entire report externally assured since FY 2010. Benchmarking against an international standard and framework that is externally validated helps CapitaLand to overcome the challenges in sustainability reporting that may arise from its portfolio of diverse asset types and geographical presence globally.

CapitaLand has been a signatory to the United Nations (UN) Global Compact since 2015 and its Communication on Progress for FY 2023 will be published at www.unglobalcompact.org. In February 2023, CapitaLand also became a signatory of the UNsupported Principles for Responsible Investment (UN PRI), as part of its commitment to invest responsibly.

For its efforts, CapitaLand continues to be listed on the Dow Jones Sustainability World Index and Asia- Pacific Index, GRESB (Global Sector Leader – Listed (Diversified) with the highest 5-star rating), FTSE4Good Index Series, MSCI Global Sustainability Indexes and The Sustainability Yearbook.

CLI's global sustainability reporting (GSR) has evolved into a uniquely hybrid model using the Global Reporting Initiative (GRI) Standards and Greenhouse Gas (GHG) Protocol (operational control method) since 2009, GRESB since 2013, Value Reporting Foundation's Integrated Reporting Framework since 2015, UN Sustainable Development Goals (SDG) Reporting since 2016, Task Force on Climate-related Financial Disclosures (TCFD)1 framework since 2017, and Sustainability Accounting Standards Board (SASB) Standards since 2020.

CLI will continue to enhance its disclosures in accordance with these standards and work towards preparing for International Sustainability Standards Board's (ISSB) standards relating to climate reporting. CLI's Global Sustainability Report (GSR) 2023 will be published by 31 May 2024 on their website.

CLI's GSR will continue to be externally assured with reference to the International Standard on Assurance Engagements (ISAE) 3000, and will cover CLI's global portfolio and employees, including our listed real estate investment trusts (REITs) and business trusts – CapitaLand Integrated Commercial Trust, CapitaLand Ascendas REIT, CapitaLand Ascott Trust, CapitaLand China Trust, CapitaLand India Trust and CapitaLand Malaysia Trust, unless otherwise indicated.

CLMT voluntarily commenced its sustainability reporting in 2015 in accordance with Bursa Malaysia's reporting guidelines and requirements, ahead of the time set for all public listed companies to disclose sustainability reporting from 2016. As a CLI-sponsored REIT, CLMT strives to emulate CLI's achievements and leadership position in sustainability and will continue to pursue opportunities where it can make a positive and meaningful impact.

CLI identifies and prioritises the management of material ESG issues that are most relevant and significant to the company and its stakeholders. It adopts a double materiality approach, considering issues which are material from either the impact perspective or financial perspective or both.

Potentially material ESG issues arising from activities across CLI's value chain (including potential risks and opportunities in the immediate and longer term) are primarily identified via ongoing engagement with CLI's business units and external stakeholders, and reviews of sources including investor questionnaires, as well as ESG surveys, sustainability benchmarks and frameworks such as Dow Jones Sustainability Indices, GRESB and SASB.

As a CLI-sponsored REIT, CLMT is guided by CLI's materiality assessment process, where the Manager conducts regular reviews, assessments and feedback in relation to ESG topics via ongoing engagement with various stakeholders including investor questionnaires and ESG surveys. Identified material issues are reported in CLMT's corporate risk register through the annual Group-wide Risk and Control Self-Assessment (RCSA) exercise, which identifies, assesses and documents material risks and the corresponding internal controls to manage those risks. These material risks include fraud and corruption, environmental (e.g. climate change), health and safety, and human capital risks which are ESG-relevant. Identified material ESG issues are then prioritised based on the likelihood and potential impact of issues affecting the business continuity of CLMT.

For external stakeholders, priority is given to issues important to the community and applicable to CLMT. In FY 2023, the material ESG topics that were identified were approved by the Board of the Manager.

More information can be found under Enterprise Risk Management on page 104 to 108 of CLMT AR 2023.

| Critical | Moderate and Emerging | |

|---|---|---|

| ENVIRONMENT |

|

|

| SOCIAL |

|

|

| GOVERNANCE |

|

As a CLI-sponsored REIT, CLMT's material ESG issues and the value created, aligned to CLI 2030 SMP focus areas and commitments, are mapped to the International Integrated Reporting Commission (IIRC) Framework's six integrated reporting Capitals – Environmental, Manufactured, Human, Social and Relationship, Organisational, and Financial. This is further mapped against eight UN SDGs that are most aligned with CLI 2030 SMP focus areas, and where CLI and CLMT can achieve the greatest positive impact.

| Our Commitments | 2023 Value Created | |

|---|---|---|

Environment

|

For CLMT:

|

Environmental Capital

Manufactured Capital

|

Social

|

For CLMT:

|

Human Capital

Social and Relationship Capital Manufactured Capital

|

Governance

|

For CLMT:

|

Organisational Capital

Human Capital

|

Economic

|

For CLMT:

|

Financial Capital |

For full 2023 Sustainability Statement, please click here.

For CapitaLand Investment's Global Sustainability Report 2023, please click here.